Advertiser Disclosure

Rewards Value Disclosure

Gemini Credit Card Review

Gemini Crypto Rewards MasterCard®

Our Rating:

Why we love this card:

- Up to 3% cash back (rewards categories TBD)

- Crypto Redemption program makes investing in crypto easier and cheaper than using FIAT.

-Gemini's app to manage your crypto is sexy and sleek.

Easy Approval Process

The Gemini credit card is now accepting applicants. Go to the landing page by clicking "Get Started". You will need to create a Gemini account before applying and earning crypto rewards.

Gemini Mastercard

The credit card for investors.-

Up to 3% crypto cash back*

-

No Annual Fee

-

Instantly claim crypto rewards

Details

- Click "Get Started" to apply for the Gemini Credit Card

- Earn up to 3% cash back / crypto rewards on purchases

- No annual fee, does require a Gemini account (which is free)

- Most likely good or excellent credit required

- No foreign transaction fees

- Cell phone protection (insurance coverage up to $1,000)

- Mastercard ID Theft Protection™

- No exchange fees to claim your rewards

Rated Best for:

Editorial Disclosure

What is the Gemini Credit Card?

What is the Gemini Credit Card?

The long-awaited Gemini credit card is finally here! Having been in the works for over a year, Gemini revealed that this card has earning categories up to 3% cash back (in the form of crypto rewards). The card is available to pre-qualified individuals that have a Gemini account and applications are open to the public since June 22, 2022.

What makes this even better than your average plastic? Not only do you get paid back with crypto, but also its security-based foundation means that there are more safeguards in place to protect your finances. Plus, Gemini has introduced this card with a $0 annual fee, but still packed plenty of features in.

If you’re a crypto enthusiast, there’s a good chance you’ve heard of the Gemini Credit Card. But what is it, and what can you do with it? In this post, we’ll break down everything you need to know about the Gemini Credit Card, including how to get one and what kinds of benefits it offers. If you’re not excited, we’ll also give you a couple alternative cards to check out towards the end. Let’s dive in.

Intro Offer or Bonus Offer

Gemini doesn’t have intro offer nor bonus offer at this time. If you’d like a cryptocurrency rewards credit card with a bonus offer checkout Upgrade’s Bitcoin Rewards credit card.

Annual Fee

Gemini’s credit card does not have an annual fee.

Gemini Card Benefits

The Gemini credit card with crypto rewards is perfect for all of you crypto enthusiasts out there. This is an innovative way to earn crypto instead of lousy miles, points or whatever your normal credit card does. It's got up to 3% cash back (but on limited categories) and what makes it unique compared to BlockFi or SoFi is that you can instantly access your crypto rewards and deposit them into your account. It's also part of World Mastercard network, which we'll cover those benefits below.

Gemini Credit Card Customization

You have three colors to choose from when designing your credit card: black, silver, and rose gold. The black card is our favorite and makes the card stand out in a line-up. When you hold the card in person, you may notice it almost has a shimmer to it when the light hits it. Gemini may add more colors or customization, but out the gate you only have these three options. Gemini does not allow you to pick your own card background or color from scratch.

Pros

- Up to 3% Cash Back (In Crypto Rewards)

- Crypto Rewards are INSTANTLY available

- $0 Annual Fee + No Exchange Fees to Withdraw Rewards

Cons

- No Intro Bonus

- 3% Cash Back is for Limited Categories

- Gemini doesn't offer a pre-qualification tool

Welcome Bonus

The Gemini credit card does not currently offer an intro bonus. This surprised us a little bit since SoFi and BlockFi both launched their cards with an intro bonus. If you only like crypto credit cards with intro bonuses, we've got you covered.

No Annual Membership Fee

The Gemini Credit Card has no AMF so you can get the card not be worried about paying a fee without using the card perks. No AMF cards are great because you can keep them open with no cost (as long as your balance is paid off) to help increase the age of your line of credits. The age of your line of credit can help increase your credit score.

Foreign Transaction Fees

The Gemini credit card has no foreign transaction fees - making it a great option for travel and nomads. There is also no transaction fee and no exchange fees when you claim your crypto rewards. Other crypto rewards cards often charge a fee to claim your rewards.

Gemini Credit Card Rewards Program

The rewards are great for investors and HODLers. You'll earn up to 3% on every purchase as long as it fits within the rewards categories. The reward tiers are 3% for dining, 2% on groceries, and 1% for everything else. You get to decide which cryptocurrency you'd like to receive rewards in. The price of your crypto is purchased is determined by the lowest sell order on Gemini Exchange’s order book - so Gemini will use acquire your crypto at the lowest price possible for you. You can get up to 3% rewards on your first $6,000 (if its within the special categories) and then 1% cash back on everything else.

No all purchases are eligible for rewards - here are the exempt ones we found:

- fees or interest charges

- balance transfers, direct or indirect

- cash advances, if applicable

- traveler’s checks, foreign currency, money orders, wire transfers or similar cash-like transactions

- unauthorized or fraudulent charges

- purchases of gift cards or reloading pre-paid cards

- purchases of cash equivalents

- person-to-person payments

You are automatically enrolled in this card's rewards program which allows you to earn cash back on eligible purchases and qualifying transactions - this list we have made is based off of other rewards cards in the same Mastercard tier so it's our best guess and not an official list from Gemini.

Other Rewards Info

You will receive rewards instantly in your Gemini exchange account, not as a statement credit. The bonus categories are fairly limited at this time, but you can earn rewards anywhere you shop in the world. Bonus categories are dining and groceries – everything else is 1% back. Cryptocurrency rewards can be exciting, but make sure you pick a cryptocurrency that will survive market downturns.

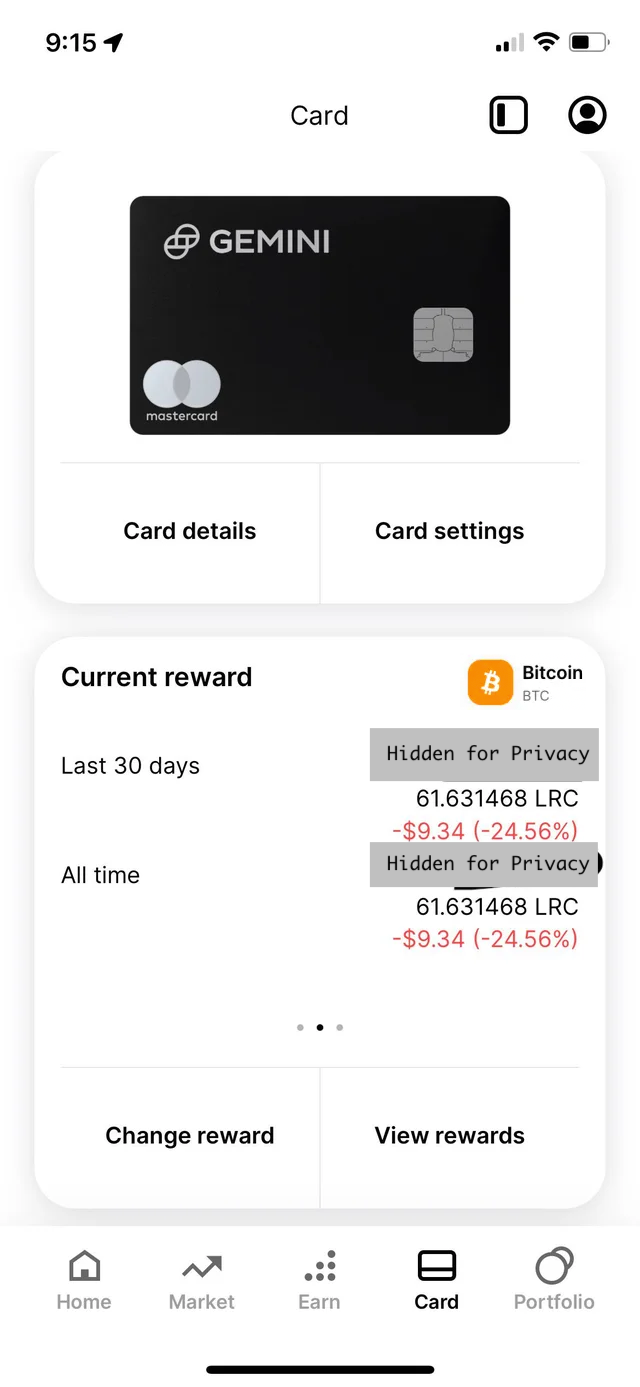

How to Choose Your Rewards

You can choose which cryptocurrency you earn as you spend with your Gemini credit card. You’ll do this in your Gemini exchange account. Here is how you pick which crypto you earn:

- Open the Gemini App

- Login with your account

- Click on the card icon on the bottom banner of the app

- Click “Change Reward”

- Select the crypto you want to earn

We found the process to choose your reward to be easy and straightforward. You can pick from over 60+ cryptocurrencies to earn with the Gemini card. These include ERC tokens, stable coins, and even meme coins.

Best Rewards Options

With over 60 different options to choose from, which options are th best to pick from the rewards list? Always do your own research, but we like the following options:

- Matic

- Chainlink

- Bitcoin

- Ethereum

- Solana

- Gemini Dollar (can be staked at a high APY)

- Wrapped Centrifuge

- Bitcoin

- Decentraland

- Shiba Inu / Doge (ultra risky)

- Axie Infinity

- Quant

Cautions

Gemini is new to the credit card game, so expect issues with their app and customer support at launch unless they invest a lot into it beforehand. Also, if you pick a risky currency or meme coin for your rewards - be aware that the rewards could significantly lose their value during a bear market or crypto winter. The Gemini Credit Card is best for those with an appetite for risk and strong belief in the future of cryptocurrency. Also if your annual spend is more than $6,000 per year, be aware that your rewards rate will be capped at 1%.

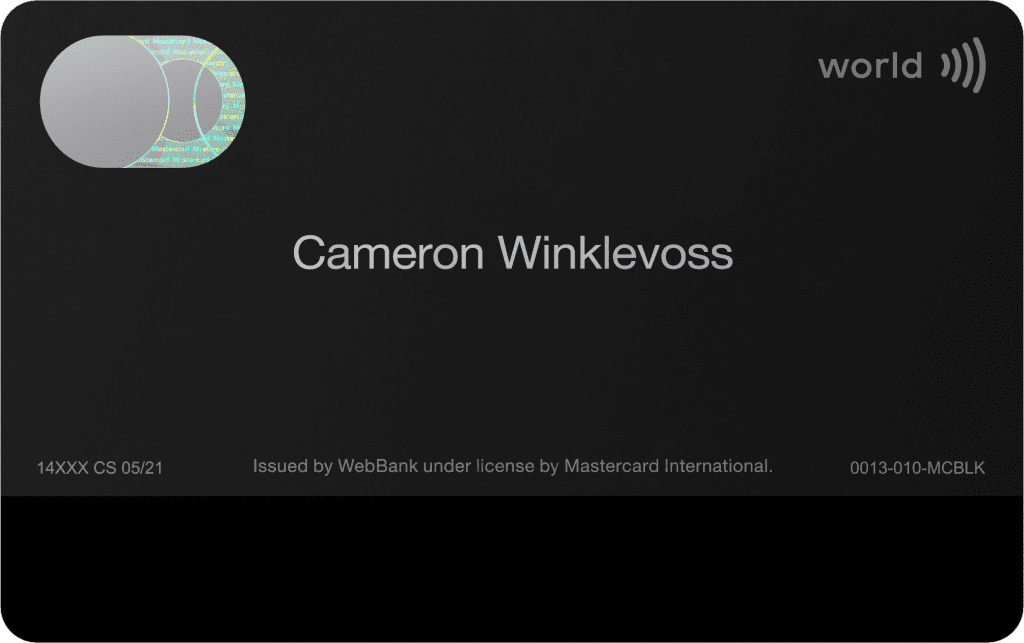

Sleek Back of Card Design

Your name will appear on the back of the Gemini credit card instead of the front like most credit cards do. In our opinion, this design is very futuristic and gives the card a high end look. The card itself is metal so it feels luxurious and sturdy when you are holding the physical card.

Why does Gemini use Mastercard Network?

Why did Gemini partner with Mastercard? Mastercard is a leading global payments & technology company that connects consumers, businesses, merchants, issuers & governments around the world. Mastercard products and solutions make everyday commerce activities – such as shopping, traveling, running a business and managing finances – faster, easier and more efficient which is why Gemini chose them as their network. Mastercard strives to make commerce more inclusive, providing financial inclusion solutions that help people who are underserved access formal financial services. Mastercard also works with governments around the world to develop innovative technologies that make it easier for everyone to participate in the global economy. As a result of Mastercard's commitment to innovation and inclusion, Mastercard is the best payments company in the world.

Summary: Our Personal Review

Our Gemini Credit Card review leads us to believe this could be the best credit card with crypto rewards for the everyday spender. With several spending categories in the 3% rewards range and instant access to crypto- the Gemini card stands out as a clear winner. We see this as an easy choice for someone who wants to earn crypto with their credit card on a reliable platform. For individuals looking for a secure, user friendly, and widely supported crypto card, the Gemini card is the right one for you. The instant rewards feature is a huge bonus to this card, especially due to the volatile nature of some cryptocurrencies. One drawback to this card is that if you’re not spending at dining locations or grocery stores, you’re only earning 1% back, which can be beaten by other competitors. To learn more about crypto credit cards in general, check out our article, “What is a crypto credit card?”

Want Gemini Card alternatives?

Gemini’s credit card may not be for everyone. If they don’t have the cryptocurrency you would like to earn or are interested in a card from a different exchange – there are options from BlockFi, SoFi, and Abra as well. If you are interested in alternative credit cards similar to Gemini, check out these cards:

(2) SoFi Credit Card

Gemini Credit Card Full Details (APR, Bonus, Fees)

Rewards Rate

Up to 3% cash back

Welcome Bonus

None

Typical Credit Score

Good, Excellent

Intro Annual Fee

$0

Annual Fee

$0

Additional User Annual Fee

$0

Foreign Transaction Fee

$0

Intro Purchase APR

None

Regular Purchase APR

TBD

Cash Advance Fee

5%, Min: $10

Cash Advance APR

TBD

Late Fee

Up to $39

Intro Balance Transfer APR

None

Regular Balance Transfer APR

N/A

Penalty APR

N/A

Balance Transfer Fee

5%, Min: $10

Return Payment Fee

Up to $39

Minimum Deposit

N/A

Credit Card Network

Mastercard

Credit Card Issuer

TBD

Gemini Credit Card Review – World of Mastercard Benefits

Gemini has one of the first crypto rewards credit card on the World Mastercard network. Aside from the crypto credit card rewards, this means that this rewards program comes with additional perks from Mastercard including:

- Mastercard ID Theft Protection™: monitor your credit file for fraud and receive alerts

- Mastercard Zero Liability Protection: You’re not held responsible for unauthorized purchases

- Global Emergency Services: Like having an emergency assistant anytime or anywhere. Get card replacement and report stolen or unauthorized activity.

Our Experience with Gemini

Our personal experience with the Gemini Credit Card has been overwhelming positive. The card works almost everywhere, there’s a great selection for cryptocurrencies you can earn, and claiming rewards is super simple. This is a credit card that I personally recommend to friends and family if they ask me for a crypto credit card recommendation. My favorite color is the black and my crypto rewards of choice is ICP.

The Gemini app adds to the experience of using this credit card. I thought the mobile app was intuitive and clean looking. It was easy to select different cryptocurrency rewards. I also moved my cryptocurrency investments into the Gemini exchange and the experience was top-notch. Gemini has really innovated during their time as a cryptocurrency exchange and I’m excited to see what other features they offer card holders.

Gemini Credit Card MasterCard FAQ

What is the minimum credit score required to apply for Gemini Crypto Credit Card?

This information is currently not available. Please refer to the Gemini Credit Card terms and conditions for more details.

What is the Intro AMF for Gemini Credit Card?

There is no Intro AMF for the Gemini Credit Card.

How do I see my crypto rewards from my Gemini Credit Card?

You can see your crypto rewards in the Gemini mobile application, which is essentially a mobile wallet.

What is the Foreign Transaction Fee for the Gemini Credit Card?

There are no foreign transaction fees currently for the Gemini credit card.

Card Rewards

- Top Rated

- Cash Back

- Gas

- Rewards

- Travel

Card Types

- Balance Transfer

- 0% Interest

Cards by Credit Score

- Excellent

- Good

- Fair

- Poor

- Limited

General Disclaimer

Crypto Cards is an independent credit card comparison service that provides analysis tools and editorial opinions. We believe in the future of decentralized finance that will provide better financial equality and transparency, we suggest using our free recommendation service which analyzes crypto wallet produce data-driven recommendations. Note that we receive compensation from some (but not all) financial or crypto products that we review which may impact where we display the products of our partners.

Editorial Disclaimer

All of the editorials offered on this site are independently contracted and scrutinized by our analyst team to avoid incentive bias. Accordingly, you can trust that the editorial opinions on this site are explicitly our own — or the community’s consensus.

© 2022 - All rights reserved

- Privacy Policy

- Terms of Service