Upgrade Bitcoin Rewards Card

Need to know more about the Upgrade Bitcoin Rewards card? In this Upgrade Bitcoin Rewards card review, we will go over how to earn bitcoin rewards, card fees, alternative cards, and the downsides of this card. The Upgrade Bitcoin Rewards Card is a new way to earn rewards for your everyday spending. In this review, we’ll take a look at the benefits, the drawbacks and how it earns Bitcoin rewards. We’ll also compare this card with other popular Bitcoin credit cards so that you can decide if it’s the right choice for you.

On Upgrade's secure site

Rates & Fees:

- 1.5% Rewards (in Bitcoin)

- APR 14.99% – 29.99%

- $200 Sign Up Bonus

- Annual Fee: $0

Crypto Cards Rating:

What we like and dislike:

- Get 1.5% unlimited cash back in Bitcoin and have the perks of a Visa® credit card.

- No minimum spend to cash out rewards

- $0 Annual Fee

- We wish the rewards rate was higher and that you could transfer your Bitcoin to a different wallet

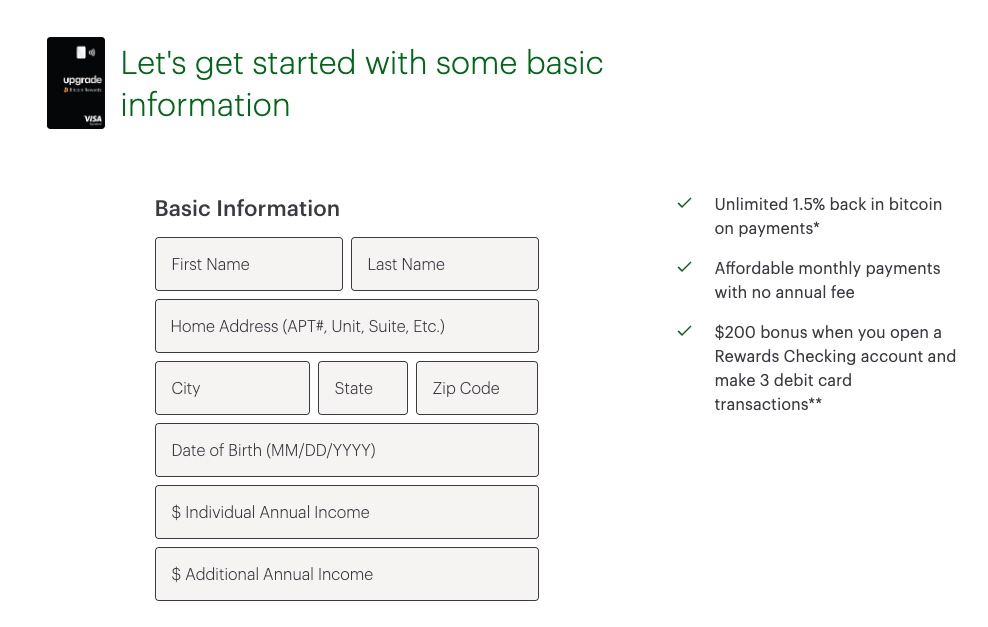

Where do I Apply

Upgrade will show you if you're pre-approved instantly without hurting your credit score. We've provided a link to see if you qualify without doing a hard credit pull - you can click "Check If I Qualify". Upgrade will require some personal information to determine your credit worthiness.

Details

- Earn 1.5% unlimited cash back that is converted to Bitcoin

- The simple way to earn bitcoin: make purchases on your card, make payments, earn bitcoin

- $0 annual fee, $0 activation fees, $0 maintenance fees

- Get pre-approved in seconds with no impact to your credit score

- Check to see if you qualify without hurting you credit score (click here)

- Pay with your phone or device by using Apple Pay™ or Google Pay™

- Mobile app to access your account anytime, anywhere

- Enjoy peace of mind with $0 Fraud liability

(1) Disclaimer Upgrade Bitcoin Rewards Visa®": * To qualify for the $200 bitcoin welcome bonus, you must open and fund a new Upgrade Rewards Checking Account and make 3 debit card transactions within 60 days of your Upgrade Card account opening. The value of the $200 worth of bitcoin provided will be based on the reference rate at the time it is purchased (within 1-2 statement periods from the date the bonus is earned) and such bitcoin may change in value by the time you are able to redeem it. See additional information applicable to bitcoin accounts and services. Your Upgrade Card must be in good standing to receive the bonus.

Rated Best for:

Editorial Disclosure

Our Personal Experience

Quick Overview of the Upgrade Bitcoin Rewards Card

The Upgrade Bitcoin Rewards Card is for all of you Bitcoin believers out there that are tired of the waitlists and want to earn Bitcoin - it's also a card generally targeted for people with bad, average or less than perfect credit. Upgrade is one of the first rewards credit cards that let's you earn Bitcoin without joining an exchange (no waitlist required). It's got generally positive feedback from its customers, but be aware this is a new company so it may not have the support and attention to details that a larger credit card company would.

Pros

- No Annual Fee

- Applying through our link doesn't hurt your credit score

- Earn unlimited 1.5% back in Bitcoin

- Upgrade allows you to check if you would qualify for the card before applying

- No foreign transaction fee

Cons

- The rewards rate is kind of low and you have to sign up for the rewards checking account to get the sign up bonus

- You can't transfer your Bitcoin you earn to another wallet, you can only cash out the value when you want to claim your rewards

- Upgrade will encourage you to consolidate your other debt to a personal loan

How do I get approved?

You can quickly checked if you're approved for the Upgrade Bitcoin Rewards Card and we have created a quick guide on how to do it without harming your credit. Try using the Upgrade "Check My Line" tool. It will show you if you are approved for their card after you fill out the info on the pre-qualification form. If you click "Get Started" you can go to a form on Upgrade's website that will allow you to see if you would qualify - checking if you qualify will not harm your credit score. You will only get a hard pull on your credit if you accept the credit offer you're offered.

Step By Step On How to Use Upgrade's Pre-Qualification Tool

- Fill out the form on the basic information page

- Double check your info, then click “Apply Now”

- If you’re approved or declined here there is not impact to your credit

- You’ll get to see your potential credit line, APR, etc. (If you qualify)

- Now, if you accept the offer that is when you’ll get a hard pull on your credit. Everything before this doesn’t impact your credit.

- If you’re declined, no further action is required. If you accept the offer they show you, you’ll get your card in the mail and can download the Upgrade App to track spending.

No Annual Fee

There is no annual fee so this is a great card to add without the worry of fees hanging over you. Having established lines of credit over a longer period of time can also bring up your credit score, so grabbing a no annual fee card like this can help you accomplish that.

Cash Back and Bitcoin Rewards

One of the most requested rewards category this year has been Bitcoin and other cryptocurrency. Upgrade is just one of several card issuers that have released a cryptocurrency rewards card. However, Upgrade's rewards card is the most widely available card that lets you earn Bitcoin. Earning Bitcoin isn't for everybody, but it does offer a potential upside for the rewards you earn. Most cards that offer Bitcoin cash back are tied to an exchange, but Upgrade is not a cryptocurrency exchange so we actually consider that a safer option at the moment.

All purchases are eligible for earning rewards except:

- Payments on non-purchase transactions, such as sending funds electronically to your bank account, are not eligible to earn rewards.

You are automatically enrolled in this card's rewards program which allows you to earn cash back on eligible purchases and qualifying transactions on offers. You'll see rewards on your statement credit in the app and be able to transfer the value of the rewards into your bank account

Benefits

The Upgrade Bitcoin Rewards Card is a new type of credit card that helps you manage your debt. It is designed to make budgeting and paying off your credit card balance easier, with fixed monthly payments and no variable interest rates. The Upgrade Card treats your debt like a personal loan, only allowing the amount owed to change when you don't pay it in full — typically within 24-60 months depending on what the card issuer approves for you.

Lastly, applicants with FICO credit scores of 600 or above can qualify for the Upgrade Card, and there aren't a bunch of hidden fees. There's no security deposit or annual fee and on-time payments are reported to the three major credit bureaus to help you continue to build your credit score.

Cautions

If you get an Upgrade Bitcoin Rewards Card - don't spend more than you can afford - be smart! Also, when you sell the bitcoin you have accumulated there will be a 1.5% transaction fee but there are also fees when you sell on a major exchange like Coinbase so we didn't find this to be abnormal. The Upgrade Card Bitcoin Card is currently not available to residents of Iowa, West Virginia, Wisconsin, and Washington, D.C. You also can't transfer the BTC you earn to another wallet, which could be a turn-off to some people.

Conclusion: Upgrade Bitcoin Rewards Card

If you love Bitcoin, believe in it, and want to accumulate more passively than this is a great card for you. If you don't care much for Bitcoin, there's probably a better rewards credit card for you.

Other Options

- Gemini Credit Card Review: Earn BTC Rewards on Gemini

- BlockFi Credit Card Review: Earn BTC Rewards on BlockFi

- Sofi Credit Card Review: Earn Cryptocurrency Rewards on SoFi

- Celsius Credit Card Review: Earn Crypto Rewards on Celsius Network

Upgrade Bitcoin Reward Card: APR & Fees

Rewards Rate

Earn 1.5% in Bitcoin

Welcome Bonus

$200 welcome bonus (see details above)

Typical Credit Score

Fair, Good, Excellent

Intro Annual Fee

$0

Annual Fee

$0

Additional User Annual Fee

$0

Foreign Transaction Fee

$0

Intro Purchase APR

None

Regular Purchase APR

14.99% - 29.99% APR (Variable)

Cash Advance Fee

N/A

Cash Advance APR

26.99%* Variable

Late Fee

N/A

Intro Balance Transfer APR

None

Regular Balance Transfer APR

N/A

Penalty APR

N/A

Balance Transfer Fee

N/A

Return Payment Fee

Up to $39

Minimum Deposit

N/A

Credit Card Network

Visa

Credit Card Issuer

Sutton

Upgrade Bitcoin Rewards Card FAQ

What is the minimum credit score required to Upgrade Bitcoin Rewards Card?

Upgrade hasn't stated what the minimum credit score that is required, luckily you can check to see if you would be approved for the card without harming you credit score.

Is Upgrade a real credit card?

Yes, Upgrade is a legitimate credit card backed Sutton Bank, Member FDIC. If you want to learn more about Upgrade, check out this article about our review of the Upgrade Card (all options).

How does Upgrade card affect credit score?

You can pre-qualify for an Upgrade card without harming your credit score - just remember if you accept the card, then that will affect your credit score. After using the pre-qualification process you can choose to accept the card Upgrade offers you which will create a hard inquiry on your credit report and will decrease your score by a couple points. However, by making on time payments and spending a third or less of your credit limit, you may start to see improvements to your credit score.

What is the Regular Purchase APR?

The Regular Purchase APR is 14.99% - 29.99%

What is the Intro Balance Transfer APR ?

This card does not support Balance Transfers.

What is the Regular Balance Transfer APR?

This card does not support Balance Transfers.

What is the Cash Advance APR?

This card does does not support Cash Advances.

What is the Cash Advance Fee?

This card does not support Cash Advances.

What is the Late Fee?

There is no Late Fee.

What is the Penalty APR?

There is no Penalty APR.

What is the Balance Transfer Fee?

This card does not support Balance Transfers.

What is the Foreign Transaction Fee?

There are no Foreign Transaction Fees for this credit card.

What is the Return Payment Fee?

There is no Return Payment Fee for this credit card.

Does Upgrade card do a hard pull?

What is Upgrade?

Upgrade is a credit card issuer that provides personal loans and credit cards to consumers with good to excellent credit. Upgrade offers a wide variety of credit products, including secured and unsecured personal loans, lines of credit, and credit cards. Upgrade also offers tools and resources to help you manage your credit and improve your credit score.

Image credit: Upgrade.com

Why earn Bitcoin?

![]()

Earning Bitcoin is not ideal for everyone, but for those that strongly believe in Bitcoin’s value and the future of cryptocurrency – Bitcoin as your rewards make sense for their credit card rewards program. Every purchase will earn Bitcoin and the potential value of the rewards will swing up and down depending on the currency price of Bitcoin. Earning Bitcoin as a rewards is not for the faint of heart, as the value could potentially drop over 90%. However, during crypto bull markets, the upside is incredible.

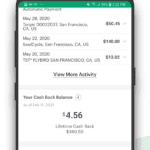

How can I see my the Bitcoin I've earned?

The best way to see the rewards is to login to the Upgrade app on your phone. Once you login, you will see a “Rewards” tab you can click on and see how much Bitcoin you have earned. You cannot transfer the Bitcoin to an external wallet. You can only redeem the value of the rewards in USD.

How do Bitcoin Rewards cards work?

These cards work similarly to other cash back or points-based rewards credit cards. With a traditional rewards credit card – you earn a certain amount of rewards per dollar spent, and those rewards can be redeemed for cash back, statement credits, or merchandise. However, with a BTC rewards card, you earn Bitcoin instead of traditional points or cash back.

What are the benefits?

There are several benefits to using a Bitcoin cash back credit card. First, you can earn a percentage of every purchase in Bitcoin. This can be especially lucrative if Bitcoin prices rise over time. Second, many rewards cards offer sign-up bonuses that can earn you a large amount of Bitcoin all at once. Finally, some cards offer additional perks, such as cash back on Bitcoin purchases, or discounts at select merchants.

What are the risks of earning Bitcoin instead of cash?

There are also several risks to earning Bitcoin. First, the value of Bitcoin is volatile, and can rise and fall sharply over time. This means that the value of your rewards may also fluctuate. Second, if you don’t carefully track your spending, it’s easy to rack up credit card debt with a credit card card. Finally, some cards charge annual fees, which can eat into your rewards earnings.

Should I get a Bitcoin Cash Back Credit Card?

Whether or not you should get a Bitcoin cash back credit card depends on your individual circumstances. If you’re risk-averse or scared of losing your rewards value – then a card like this is not the best fit for you.

Earn Crypto Passively

We select the best products to accumulate more of the cryptos that you love.

No commitment to apply.

General Disclaimer

Crypto Cards is an independent credit card comparison service that provides analysis tools and editorial opinions. We believe in the future of decentralized finance that will provide better financial equality and transparency, we suggest using our free recommendation service which analyzes crypto wallet produce data-driven recommendations. Note that we receive compensation from some (but not all) financial or crypto products that we review which may impact where we display the products of our partners.

Editorial Disclaimer

The editorial content on this page is based solely on objective, independent assessments by our writers and editors and is not influenced by advertising or partnerships. It has not been provided or commissioned by any advertiser. However, we may receive compensation when you click on links to products or services offered by our partners. This helps us keep this website free and informative.

© 2022 - All rights reserved

- Privacy Policy

- Terms of Service