BlockFi Credit Card Review: Personal Review from a Crypto Enthusiast

On BlockFi's secure website.

Crypto Cards Rating:

Why we love this card:

-Earn up to 10% back on special categories

-Get 1.5% unlimited cash back in Bitcoin or dozens of other cryptos of your choice, Plus earn interest on your crypto rewards in the BlockFi App

- $0 Annual Fee

- Luxurious, black-brushed metal design

Easy Approval Process

BlockFi will show you if you're pre-approved instantly without harming your credit score. We've linked to their application page by clicking "Get Started" and you can apply on their secure website.

BlockFi Rewards Visa Signature

The credit card for Bitcoin believers-

Pick the crypto you want to earn

-

10% back on special categories

-

Earn unlimited rewards, backed by Visa®

-

See if you're Pre-Approved with no harm to your credit score.

Details

- Earn up to 10% back on special spending categories

- $0 annual fee. $0 foreign transaction fees.

- Uncapped rewards program means unlimited earning potential

- Check to see if you qualify without hurting you credit score (click here)

- Enjoy Visa's $0 Fraud liability

- Earn 2% back in Bitcoin on every purchase over $50,000 of annual spend.

- Click GET STARTED to securely apply online.

Rated Best for:

Editorial Disclosure

BlockFi Rewards Visa®️ Credit Card Review

What is the BlockFi Rewards Visa®️ Credit Card?

The BlockFi Rewards Visa®️ Credit Card is for people who want to earn Bitcoin and essentially create a stream of passive income from their credit card rewards. The ability to earn 1.5% back in Bitcoin along with a 2% APY in BlockFi's ecosystem means you have the potential to earn rewards and then make interest on the rewards you've accumulated. Even though BlockFi is a newer card, it is backed by the Visa network and is accepted globally. BlockFi. The average BlockFi user accumulates around $40 in crypto per month, just for using their card on everyday expenses. Read more on how the BlockFi cash back card works.

Pros

- No Annual Fee

- Checking if you qualify through our link doesn't hurt your credit score

- Earn 1.5% in Bitcoin (or other cryptocurrencies) on almost everything

Cons

- 1.5% cashback isn't the best we've seen, but the other rewards can make up for that (see below)

- BlockFi used to have a 3.5% cash back intro offer that is not available anymore

Bitcoin Rewards / Crypto Rewards

The BlockFi rewards Visa Signature goes far beyond the 10% special category bonuses and 1.5% cash back in crypto. You can earn crypto interest on your Bitcoin rewards, using a 2% APY bonus in Bitcoin on your stable coin holdings. These additional rewards are capped, so you get 2% APY bonus up to $200 a year, which means if you have more than about $10,000 in stable coin, then it doesn't really help that much. However, before you hit $10,000, or if you have $10,000, then you get an extra $200, you get about 0.25% back in Bitcoin on all eligible trades, which is icing on the cake. Your baseline reward amount is 1.5% back in Bitcoin (or the crypto of your choice). Also, for the heavy spenders out there, if you spend over $50,000 in a year on the card, you’ll be bumped up to a 2% rewards tier.

Stablecoin Bonus

Another perk to keep in mind is the stablecoin rewards bonus on your card anniversary date – it is an extra 2% APY on stablecoin balances. This is another perk that makes this card better than normal cash rewards. Within your BlockFi account it’s hard to find your card anniversary date, so keep it written down so you can keep an eye out for that bonus payout.

Up to 10% back in Crypto Rewards

BlockFi also partnered with Cardlytics to offer up to 10% cash back on a select list of brands. You’ll also be able to claim these rewards in the form of Bitcoin or dozens of other cryptocurrencies. The list of brands and stores changes where you can earn up to 10% back in crypto, but brands like Adidas, Shake Shack, H&M, Finish Line, Costco, and Meta Quest have all been on the list before. The BlockFi Rewards Visa Signature card continues to add rewards and has already awarded $26 million in crypto to its user

The current list of cryptocurrency options you can choose as your reward has expanded since the launch of the card. Initially you could only earn Bitcoin, but now you can earn 15 other cryptocurrencies.

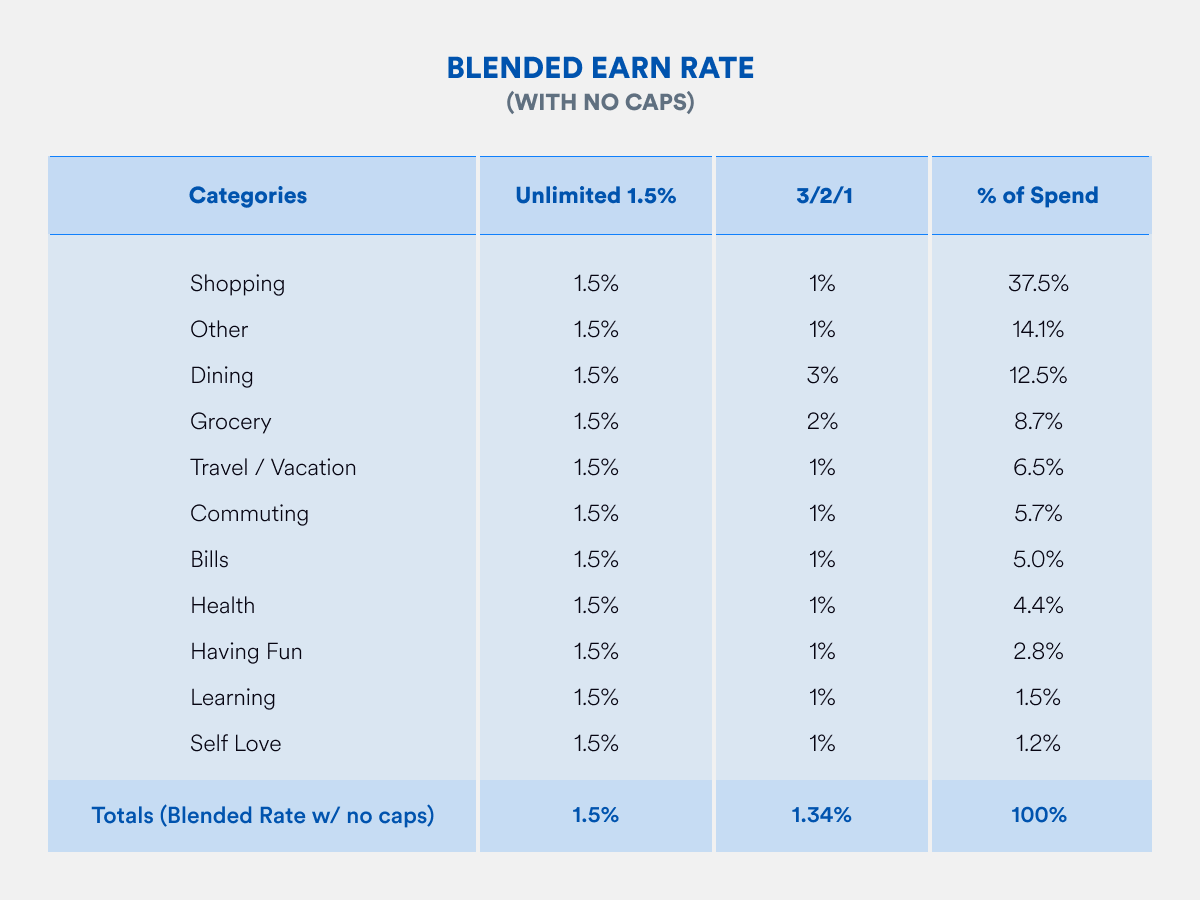

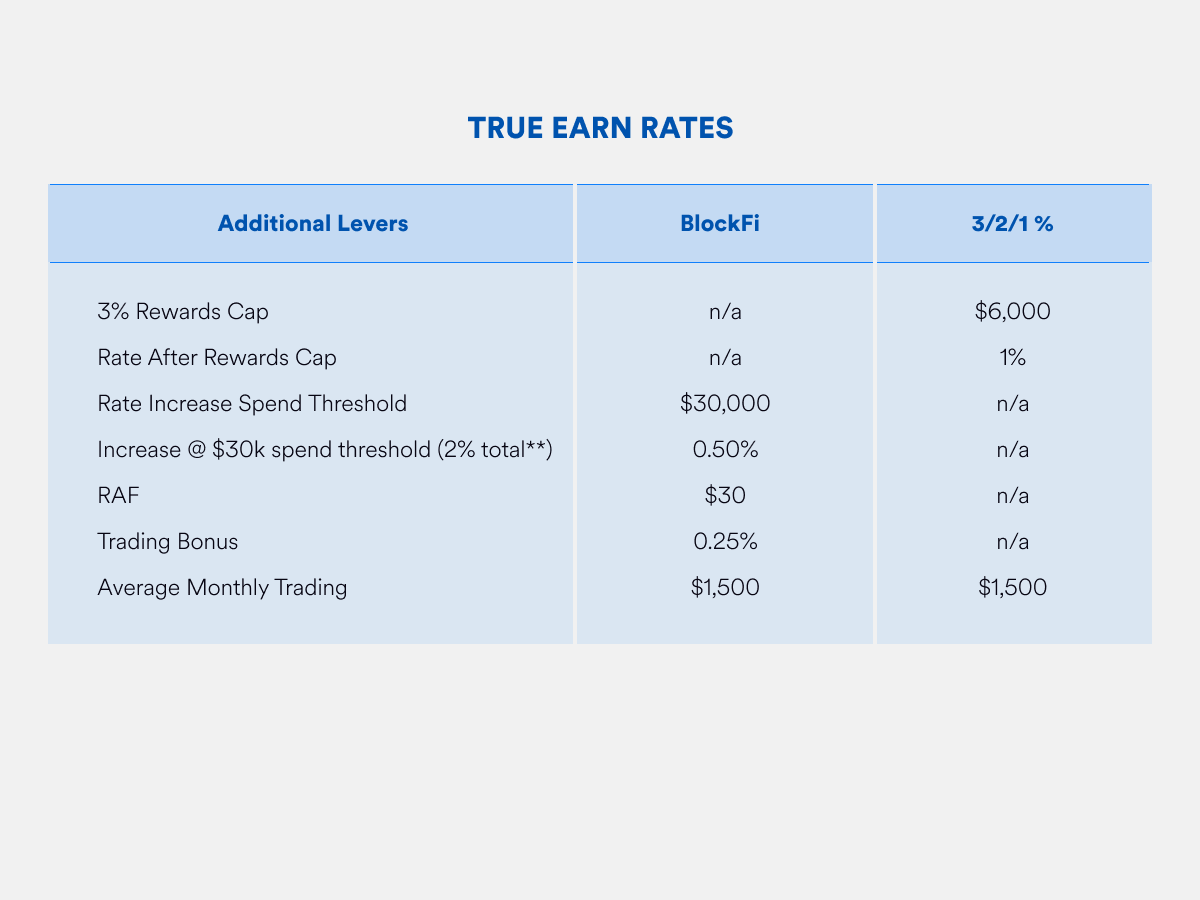

BlockFi has also provided other comparison charts to show how you can maximized your crypto rewards with their card:

No Annual Fee

BlockFi's Visa Signature card changed it’s initial plan and this card is launching with no annual fee. BlockFi had at one point planned to have a $200 annual fee, but by making the card free to use, it makes it one of the best crypto credit cards on the market. Along with the no annual fee, there are no foreign transaction fees. So if you're traveling to a different country or a different place, there is going to be no foreign transaction fee. Recently, my other credit card raised it's annual fee to $695 so you're getting a lot of value out of a free credit card.

Qualifying Purchases

- Anything except cash advances, balance transfers, convenience checks, payments made for stored value cards such as gift cards and similar cards, wire transfers, money transfers, travelers checks and similar products that may be converted to cash.

- Purchases won't count towards rewards if you are past due on your account.

You are automatically enrolled in the rewards account and BlockFi's interest account so you can start earning interest on your rewards.

Unboxing the BlockFi Card

Unboxing this card makes you feel like a boss. It's like unboxing $300 headphones. If you're like us, it will feel like opening a present on Christmas morning:

Perks of Visa Signature

The Blockfi rewards Visa Signature also includes some top-tier features: No annual fee, complimentary concierge service, access to exclusive events and experiences, travel accident insurance, auto rental collision damage waiver, emergency assistance services, purchase protection and extended warranty protection. Along with the Visa Signature perks, you can access higher APYs, custom rewards, and get instant access to your card in your BlockFi account.

Cautions

![]() Don't spend more than you can afford - a credit card isn't right for everyone. Used wisely, it's a great way to earn rewards and build your credit. The BlockFi Rewards Visa Signature card is only available in "qualified states". Your state might not be available, but you can click the "Get Started" button below to check.

Don't spend more than you can afford - a credit card isn't right for everyone. Used wisely, it's a great way to earn rewards and build your credit. The BlockFi Rewards Visa Signature card is only available in "qualified states". Your state might not be available, but you can click the "Get Started" button below to check.

My Personal Opinion

The BlockFi Rewards Visa Signature card is a game changer in the credit card world. They're one of the first CrossFi cards (crossing DeFi and Traditional Finance) and can turn rewards into an exciting investment opportunity. Bitcoin is volatile so proceed with caution, but this is a way to accumulate with very low risk to you. 66% of BlockFi rewards card users have made this their primary card because they see more value in crypto rewards than traditional points.

BlockFi Credit Card Alternatives

BlockFi's Visa Signature card was the first credit card to offer crypto rewards, but there are plenty of others who have come along and have amazing rewards programs as well. If you are interested in some other options, you should check out our other crypto credit card reviews:

Complete Card Details

Rewards Rate

Earn 1.5% in Bitcoin + 2% APY on Bitcoin

Welcome Bonus

N/A

Typical Credit Score

Good, Excellent

Intro Annual Fee

$0

Annual Fee

$0

Additional User Annual Fee

$0

Foreign Transaction Fee

$0

Intro Purchase APR

None

Regular Purchase APR

14.99% to 24.99% (Variable)

Cash Advance Fee

N/A

Cash Advance APR

N/A

Late Fee

Up to $25

Intro Balance Transfer APR

None

Regular Balance Transfer APR

N/A

Penalty APR

N/A

Balance Transfer Fee

N/A

Return Payment Fee

Up to $37

Minimum Deposit

N/A

Credit Card Network

Visa

Credit Card Issuer

Deserve Inc

BlockFi Rewards Credit Card FAQ

What is the minimum credit score required to BlockFi Rewards Card ?

Is the BlockFi Rewards Credit Card a real credit card?

Is there a hard credit pull to apply for the BlockFi Credit Card?

The BlockFi credit card application does a soft pull to see if you are approved. A hard credit pull occurs if you accept the offer. This soft credit pull does not show up negatively on a credit report.

Is the BlockFi credit card metal?

Yes the BlockFi credit card is partially metal, it feels sturdier and is more durable than a standard plastic credit card.

Does BlockFi have a credit card?

Yes, BlockFi has a credit card that allows you to earn Bitcoin on every transaction. Additionally you can earn interest on the rewards you’ve accumulated and the reward value will go up as Bitcoin’s value increases.

What bank is BlockFi credit card?

The BlockFi Bitcoin Rewards Visa Signature Card has two partners: Deserve, Inc. and Evolve Bank & Trust. Deserve handles the underwriting, processing, and issuance of the BlockFi Bitcoin Rewards cards and Evolve extends the lines of credit. BlockFi partnered with these two companies to be able to get the BlockFi card to market. BlockFi handles all of your rewards if you are a cardholder.

How does BlockFi's credit card affect credit score?

What is the Regular Purchase APR for the BlockFi Rewards?

The Regular Purchase APR for BlockFi's Rewards Visa® Credit Card is 14.99% - 24.99%

Is BlockFi credit card legit?

Yes, the BlockFi credit card is legit as it gets. BlockFi’s card is on the Visa network so it is reliable, safe, and can be used almost anywhere in the world.

What is the Cash Advance APR for the BlockFi Rewards Visa®?

The BlockFi Rewards Visa® Credit Card does not support Cash Advances.

What is the Cash Advance Fee for the BlockFi Rewards Visa®?

The BlockFi Rewards Visa® Credit Card does not support Cash Advances.

What is the Late Fee for BlockFi Rewards Visa®?

The late fee for the BlockFi Rewards Visa® Credit Card can be up to $25.

What is the Penalty APR for BlockFi Rewards Visa®?

There is no Penalty APR for the BlockFi Rewards Visa® Credit Card.

What are the Balance Transfers Fees for the BlockFi Rewards Visa Signature?

The BlockFi Rewards Visa® Credit Card does not support Balance Transfers.

What are the Foreign Transaction Fees for BlockFi Rewards Visa® Signature?

There are no Foreign Transaction Fees for this credit card.

What is the Return Payment Fee for BlockFi Rewards Visa®?

The Return Payment Fee for this credit card is up to $37.

No commitment to apply.

General Disclaimer

Crypto Cards is an independent credit card comparison service that provides analysis tools and editorial opinions. We believe in the future of decentralized finance that will provide better financial equality and transparency. Note that we receive compensation from some (but not all) financial products that we review which may impact where we display the products of our partners.

Editorial Disclaimer

The editorial content on this page is based solely on objective, independent assessments by our writers and editors and is not influenced by advertising or partnerships. It has not been provided or commissioned by any advertiser. However, we may receive compensation when you click on links to products or services offered by our partners. This helps us keep this website free and informative.

© 2021 - All rights reserved

- Privacy Policy

- Terms of Service