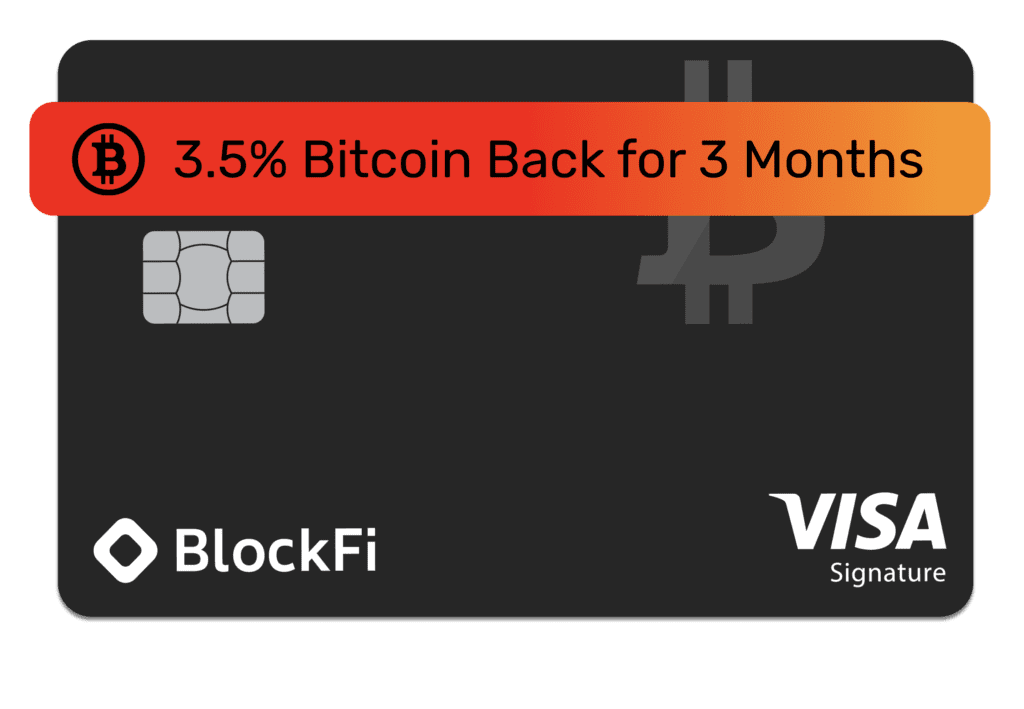

- $0 Annual Fee

- Backed by the Visa network

- Earn 3.5% back for 3 months

On BlockFi’s secure site.

In case you already missed it, the BlockFi credit card is already out. It was released in 2021 and has quickly become a popular option for rewards credit cards.

Here are the top features of this credit card:

1) Earn 1.5% back in Bitcoin, Ethereum, LTC, and other major coins

2) Earn 3.5% back on every purcahse for your first 3 months

3) Earn interest on your rewards that you hold on your BlockFi account

4) The card annual fee has been reduced to $0, it was initially going to be $295 per some reports.

5) You can create a BlockFi account to see if you qualify.

If you would like to read our full review – check out the Crypto Cards BlockFi Review here.

Why get a BlockFi credit card?

BlockFi’s credit card is a great option for people who are interested in crypto but want a low risk way of accumulating it. By switching your credit card to BlockFi, you can earn rewards as you would with a standard rewards credit card but choose to get cryptocurrency instead of points or cash back. This card has gotten extremely popular because it allows people to get crypto without allocating of their funds to do so. BlockFi also picked a great network (Visa) to be on, because it is accepted world wide and adds peace of mind to new BlockFi customers.

Will it hurt my credit score to apply to BlockFi?

The credit card application has a tool that allows you to see if you would qualify before any harm to your credit score. You can use that tool here. A soft credit pull will take place when you enter your information. There won’t be a hard credit pull (which does slightly ding your credit score) until you accept the credit card offer and finish the application.

Alternatives to the BlockFi Card

The BlockFi card is a solid option, but if you have below average credit – you may not qualify for it. You can try applying for the Upgrade Bitcoin Rewards Card instead, it allows you to earn Bitcoin at a rate of 1.5% on each purchase.